4Sight Insurance is an insurance provider that primarily focuses on offering personalized and affordable coverage to individuals and businesses. However, specific details about the company, such as its history, customer service quality, or particular product offerings, may be less readily available compared to larger, more widely known insurers. Below is a general breakdown of key factors you might consider when evaluating 4Sight Insurance or any smaller, independent insurance company:

4 Sight Insurance Company Review

1. Types of Coverage

- Personal Insurance: Many smaller insurers like 4Sight offer personal policies, including auto, home, life, and renters insurance.

- Commercial Insurance: They may also provide business coverage, such as general liability, property, workers’ compensation, and other business-related policies.

- Specialty Insurance: Some companies like 4Sight may offer niche policies for specific needs, such as high-risk auto, boat insurance, or insurance for unique assets.

2. Customer Service

- Availability: Smaller insurers tend to have a more localized, personalized service approach, which can be advantageous for clients seeking hands-on assistance.

- Claims Process: Look for reviews or testimonials related to the ease of filing claims. A good insurer should have an efficient and transparent claims process.

- Online Presence: It’s important to see if the company offers online tools for customers to manage policies, make payments, or file claims.

3. Pricing

- Competitive Rates: Smaller or independent companies can sometimes offer more competitive rates than larger insurers, depending on the market they serve. It’s always a good idea to get quotes from multiple providers to ensure you’re getting the best deal.

- Discounts: Look for any discounts the company may offer (e.g., bundling policies, safe driver discounts, or loyalty discounts).

4. Financial Stability

- Ratings: Check ratings from independent rating agencies like A.M. Best or Standard & Poor’s. These agencies evaluate the financial strength of insurers and can help assess whether the company will be able to pay claims in the future.

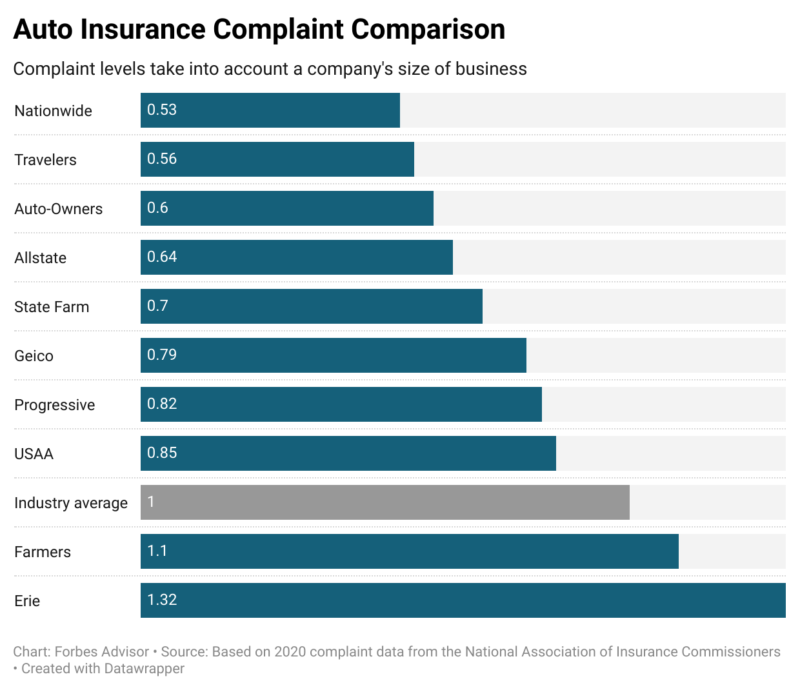

- Reputation: Consider looking up customer reviews and complaints. Some users may share experiences that can give you an insight into the company’s financial reliability and service quality.

5. Availability and Accessibility

- State Availability: Ensure that 4Sight Insurance operates in your state, as not all insurers are licensed in every area.

- Customer Support Channels: Check if the company offers accessible customer support, such as 24/7 phone support, live chat, or a mobile app for easier policy management.

6. Claims Satisfaction

- Customer Reviews: Reading consumer reviews on platforms like Google, Yelp, or Trustpilot can provide a sense of customer satisfaction. If the company has high ratings for handling claims efficiently, that’s a positive sign.

- Speed and Transparency: A good indicator of an insurance company’s reliability is how quickly and transparently it handles claims.

7. Online Tools & Technology

- Mobile App or Online Portal: In today’s digital age, a good online experience can make a big difference in how easily you can manage your policies. Check if 4Sight Insurance has an intuitive website or mobile app for managing claims, paying bills, or accessing documents.

Conclusion

While specific reviews of 4Sight Insurance may not be as widely known as major players in the industry, the key to evaluating any insurer is to carefully compare their offerings, customer service, financial stability, and feedback from current and past clients. If you are considering this company for your insurance needs, gathering quotes, reading available reviews, and even speaking with an agent directly can give you a clearer picture of whether they are the right fit for your personal or business coverage needs.

Leave a Comment