Adrian Flux Insurance is a UK-based insurance broker that offers a wide range of insurance products, specializing in providing coverage for niche and non-standard insurance needs. Established in 1973, Adrian Flux has built a reputation for offering competitive and flexible insurance solutions for drivers, homeowners, and businesses, particularly those with specific needs or risk profiles that may not be well-served by mainstream insurers.

Here’s a detailed review of Adrian Flux Insurance in 2024, covering its products, customer service, pricing, and overall reputation.

1. Types of Insurance Coverage Offered

Adrian Flux is known for offering a broad array of insurance products, with a particular focus on specialized and non-standard coverage. Some of the key types of insurance they provide include:

- Car Insurance: Adrian Flux specializes in non-standard and high-risk car insurance policies, including:

- Modified car insurance for vehicles with custom parts or alterations.

- Classic car insurance for owners of vintage or historic vehicles.

- Young driver insurance, often tailored to younger, less experienced drivers.

- High-performance car insurance for drivers of sports cars or high-powered vehicles.

- Specialist car insurance, including coverage for imported vehicles, electric cars, and more.

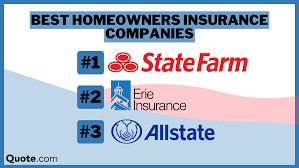

- Home Insurance: Adrian Flux also offers a range of home insurance policies, including:

- Standard home insurance for regular homeowners.

- Non-standard home insurance, catering to high-risk properties, such as those with unusual construction or located in flood-prone areas.

- Landlord insurance for rental property owners.

- Holiday home insurance for second homes or properties let to guests.

- Van Insurance: Coverage for both personal and commercial van owners, including:

- Specialist van insurance for modified or high-value vans.

- Commercial van insurance for businesses using vans for work purposes.

- Motorbike Insurance: Adrian Flux offers motorbike insurance for standard and modified motorcycles, including coverage for scooters, touring bikes, and classic motorbikes.

- Business Insurance: For small and medium-sized businesses, Adrian Flux offers various commercial insurance options, including:

- Public liability insurance

- Employer’s liability insurance

- Property and stock insurance

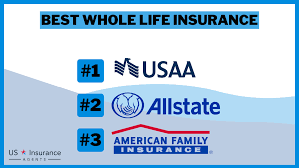

- Life and Health Insurance: Adrian Flux also partners with other providers to offer life insurance and health insurance, though these are not its primary focus.

2. Customer Service and Claims

Adrian Flux is an insurance broker, meaning it works with a variety of insurance providers to find the best coverage for its customers, rather than being an insurer itself. Here’s a breakdown of its customer service and claims handling:

- Customer Service: Adrian Flux is known for providing a personalized service and often works closely with customers to tailor policies to their specific needs. They have an experienced team available by phone or online to help with quotes, policy changes, and other inquiries.Reviews about their customer service are generally positive, with many customers noting that they take the time to understand individual needs. However, as with many brokers, experiences can vary depending on the complexity of the case and the specific provider they use.

- Claims Handling: As an intermediary, Adrian Flux helps customers navigate the claims process with the insurer they place the policy with. Reviews about Adrian Flux’s role in handling claims tend to be mixed, as customer satisfaction often depends on the insurer’s performance. That said, Adrian Flux does have a reputation for assisting with difficult claims, particularly for non-standard or modified cars.

- 24/7 Claims Assistance: Some insurance providers partnered with Adrian Flux offer 24/7 claims support, especially for car and home insurance, which can be a major plus for policyholders.

3. Pricing and Discounts

One of Adrian Flux’s key selling points is its competitive pricing for non-standard and niche insurance products. They are particularly strong in offering affordable coverage for:

- High-risk drivers (young drivers, drivers with convictions)

- Modified cars

- Classic cars and performance vehicles

Because Adrian Flux works with various insurers, it’s often able to offer more flexible terms and rates than traditional insurers. However, like many brokers, premiums can vary depending on the risk profile, type of vehicle, and personal circumstances.

Adrian Flux also offers various discounts for things like:

- Multi-policy discounts if you combine car and home insurance.

- No-claims bonuses.

- Low-mileage discounts for drivers who don’t use their cars frequently.

4. Financial Stability and Reputation

As a broker, Adrian Flux itself doesn’t need to hold capital reserves like insurers. However, it works with well-established insurance providers to offer policies. The company is regulated by the Financial Conduct Authority (FCA), which ensures it operates in a way that protects consumers.

While Adrian Flux is a relatively small company compared to some of the larger UK insurers, it has earned a strong reputation in its niche market. It is especially well-regarded for offering specialized coverage for cars that might be difficult to insure with mainstream providers.

5. Online Tools and Technology

Adrian Flux provides various online tools to help customers manage their policies, get quotes, and make payments. Customers can get an instant quote for some policies directly on their website, and they offer a customer portal for managing policy details and making changes.

- Quote Process: Adrian Flux’s online quote process is straightforward and allows you to get a quote for a variety of insurance types (car, home, van, motorbike, etc.). The website offers a user-friendly experience, though it can be somewhat lengthy when getting quotes for specialized products like modified cars or classic cars.

- Mobile App: As of 2024, Adrian Flux doesn’t have a widely recognized mobile app for managing policies, which is a potential area for improvement.

6. Pros and Cons of Adrian Flux Insurance

Pros:

- Specialized Coverage: Adrian Flux excels at providing insurance for high-risk and non-standard customers, including young drivers, modified cars, and classic cars.

- Competitive Pricing: Often offers competitive rates compared to mainstream insurers, especially for niche or high-risk coverage.

- Personalized Service: Known for a more hands-on, tailored approach when it comes to customer service and finding the right coverage.

- Wide Range of Products: Offers a broad selection of insurance products, from car and home insurance to business insurance.

Cons:

- Customer Reviews Can Be Mixed: While many customers are satisfied, others report issues with claims handling or communication with specific insurers.

- No Mobile App: Lacks a dedicated mobile app for easy policy management, which is something that many larger insurers now offer.

- Broker-Dependent: As a broker, Adrian Flux doesn’t handle claims directly and relies on the insurance companies it works with to process claims. This can lead to inconsistencies depending on the insurer’s quality of service.

7. Customer Reviews

Customer feedback for Adrian Flux is mixed, with many praising the company for its competitive prices and personalized service, especially for more complex insurance needs. However, as with many brokers, some customers have reported issues with claims handling, particularly when dealing with third-party insurers.

Many reviews highlight positive experiences for those looking for insurance for modified or high-performance cars, as Adrian Flux is particularly adept at covering these types of vehicles.

Conclusion: Is Adrian Flux Insurance Right for You?

Adrian Flux Insurance is a strong option for people who have non-standard insurance needs, such as modified cars, young drivers, or those with specific business requirements. They offer specialized coverage that may not be easily available through larger, mainstream insurers.

For those with more standard insurance needs (e.g., regular car insurance or home insurance), Adrian Flux may not always be the most cost-effective option compared to other major insurers, but it is worth considering for its ability to offer competitive rates in niche areas.

Leave a Comment