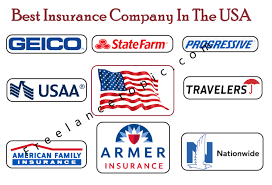

When choosing an insurance company, the best one for you can depend on factors like the type of insurance (e.g., auto, home, life, health), your budget, customer service needs, and the level of coverage you’re looking for. However, based on factors such as financial stability, customer satisfaction, range of offerings, and claims processing, here are five of the best insurance companies in the U.S. for general coverage:

best insurance companies in usa

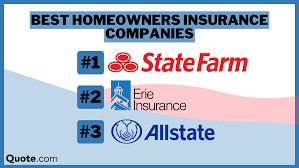

1. State Farm

- Best For: Auto, Home, Renters, Life Insurance

- Why it’s great:

- State Farm is the largest provider of auto and home insurance in the U.S. They offer a wide range of policies and are known for excellent customer service and claims processing.

- They have a strong financial stability rating and are widely accessible, with a large network of agents.

- Pros:

- Reliable claims service

- Extensive network of agents

- Discounts for bundling policies

2. Geico

- Best For: Auto Insurance

- Why it’s great:

- Known for offering affordable rates, especially for drivers with clean records.

- Geico’s online tools and mobile app make it easy to manage your policy.

- They have strong customer satisfaction ratings for auto insurance.

- Pros:

- Competitive rates, especially for drivers with a good history

- 24/7 customer service and easy online claims processing

- Wide range of discounts (e.g., good student, military, bundling)

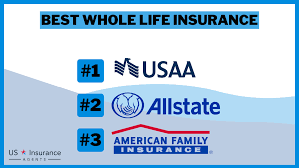

3. Allstate

- Best For: Auto, Home, Renters, Life Insurance

- Why it’s great:

- Allstate offers a broad array of policies, including auto, homeowners, and life insurance.

- Their “Good Hands” customer service is widely regarded as excellent, and they offer a wide range of discounts.

- They also provide a unique program called Drivewise, which rewards safe driving habits.

- Pros:

- Strong customer service reputation

- Discounts for safe driving and bundling policies

- Large network of agents

4. Progressive

- Best For: Auto Insurance, Homeowners, Renters Insurance

- Why it’s great:

- Progressive is known for its competitive rates, especially for high-risk drivers or those with a history of claims.

- They offer a wide variety of insurance types and customizable coverage options.

- They also have the “Name Your Price” tool, which helps tailor coverage to your budget.

- Pros:

- Excellent online tools and mobile app

- Discounts for safe driving, bundling, and paying in full

- Flexible coverage options

5. USAA

- Best For: Military families (auto, home, life, renters insurance)

- Why it’s great:

- USAA is often considered the top choice for military families, providing competitive rates and excellent customer service.

- USAA offers a wide range of insurance options tailored to the needs of military members and their families.

- Highly rated for customer satisfaction and claims handling.

- Pros:

- Exceptional customer service and satisfaction ratings

- Special discounts and programs for military families

- Excellent financial strength and stability

Honorable Mentions:

- Farmers Insurance: Known for a strong presence in both auto and home insurance, with personalized policies.

- Nationwide: Offers a broad range of insurance products with good customer service and competitive rates.

- Chubb: Excellent for high-net-worth individuals seeking specialized home, auto, and umbrella insurance.

Each of these companies has its strengths, so the best choice will depend on your individual needs. It’s often a good idea to get quotes from several providers to compare coverage and pricing based on your personal circumstances.

Leave a Comment